However, ongoing research from various industry players demonstrates just how much the world has depended on the internet over the last six weeks.

On 10 March, the world’s largest internet exchange DE-CIX Frankfurt, recorded a new all-time traffic peak of more than 9.1 Terabits per second – a feat originally expected to happen around “the end of 2020”.

Around the world, service providers are backing DE-CIX Frankfurt’s observations. To cherry pick a few: Verizon reported a 34% increase in VPN traffic between March 10 and 17, while gaming traffic increased 75%; Vodafone has seen a 50% rise in internet use in some European countries; and AT&T has seen a 40% rise in mobile volumes and a 100% increase in Wifi calls. Mobile operators around the world have also reported a sharp increase in Wifi use.

The result? Speedtest.net reports that when compared to the week of March 2, 2020 global fixed speeds declined an average 3% while mobile speeds are down 6%.

“Put simply data traffic skyrocketed after the lockdown,” says John Giere, president of Enea Openwave.

“Telefonica’s Movistar, Orange, Vodafone, Másmóvil and Euskaltel also reported that IP network traffic had increased 40%, while mobile increased 50% for voice and 25% for data,” he adds.

According to Enea Openwave, in Italy peak throughput increased by up to 90% compared to the weeks before lockdown. Spain experienced a 35% increase in throughput, while over fixed networks it increased 50%. South America saw an average growth of 25-30% in traffic. In India it was a 25% increase.

“These are more than the regular surge that operators expect during their busy hour, and they are being sustained over days and weeks” Giere adds.

Traffic trends

In the four weeks to 20 March, Nokia reported a 20–40% peak increase – usually in evenings – in impacted regions.

On day one of Western Europe’s lockdown, social media was the entertainment and communication method of choice, with WhatsApp seeing an increase of 117–217% at various points over a single day. Over the course of that day, overall traffic increased between 30% at 5pm and 80% at 9am, with boosts between 50% and 70% for most of the day.

“Time will tell if these changes are permanent, but many precedents have been made in the areas of distance learning, online shopping – on a very large scale – videoconferencing, collaborative work and content sharing, et cetera.,” says Craig Labovitz, CTO for Nokia Deepfield.

By week commencing March 23, most networks in lockdown environments had settled into the new normal and were showing little or no growth at weekend peak hour (9 pm local) – but some networks in Europe exhibited 20% of traffic growth from the previous week (64% of growth from Feb 1).

By early April, distributed Denial of Service (DDoS) traffic was also up by more than 40%, while subscriber upstream traffic – above 30% on average – continued to grow.

Looking ahead, Labovitz says that things could soon start to quieten down.

“It’s always hard to make predictions.

“What we have seen is an accelerated evolution – yearly traffic growths being achieved in a matter of weeks, sometimes even days. It is unlikely that the extraordinary traffic increases will continue.

“However, many networks are already operating at 20%-40% over their pre-pandemic traffic levels, especially when looking at the peak traffic times, for example weekend evenings when the usage of streaming video on demand is greatest,” Labovitz adds.

The problem with video

In Italy, Spain and in most other countries, the increase in the volume of data is mainly driven by video. As an example, there has been a 20% daily increase in Amazon Prime traffic in Italy, Enea Openwave noted.

In its studies, Nokia’s Deepfield analytics team found Disney+ was responsible for 18% of all internet video traffic (coming over peering links) in some countries in Europe during its first week of launch, and 8% of streaming video delivered to subscribers.

Video conferencing has been very popular too.

Nokia found continued and high traffic levels during business hours has mostly been driven by video conferencing applications, including 700% growth for Zoom in some US networks week commencing March 23 – 29.

But video continues to cause issues. Giere says that, prior to lockdown, the biggest headache for operators was trying to manage the growing levels of OTT encrypted traffic and HD video; now it has reached a new level, so too has the problem.

“This problem is now very real. After the lockdown, the EU called on the video providers to effectively reduce quality and stream over Standard Definition. Netflix, Amazon and some video service providers however are not restricting higher resolutions; instead, they are readjusting and changing encoding for the existing qualities," he says.

Giere advises this fix could aggravate congestion – even when adaptive bit rate technologies are used – because video applications will always consume as much data as possible to ensure they offer the highest available quality.

“To tackle this challenge, operators must have the technology to detect congestion on the access network, aggregation points and backhaul and respond dynamically to balance video quality. That is how operators can flatten the communications curve for the traffic surge,” he says.

Network outages

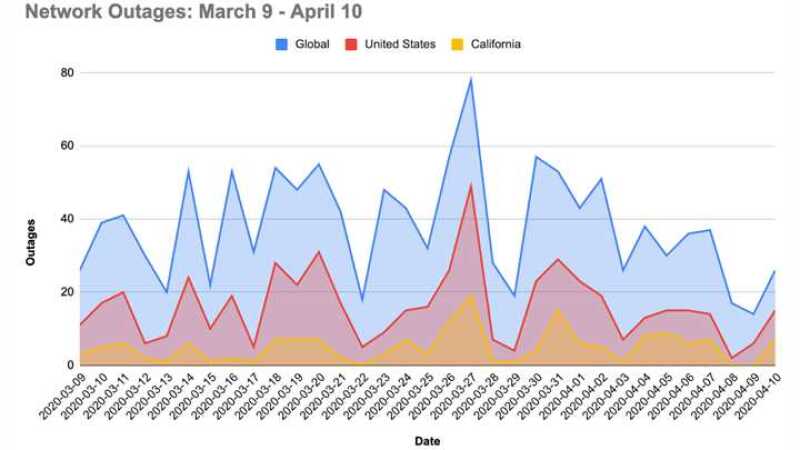

Analysing internet demand and outages ThousandEyes reported that global outages were at an “all time high” throughout March, only dropping below 300 in the week March 30 – April 5. That week, global outages were down 9.13% from the previous week, and US outages were down 16%.

However, there was an increase in the duration and scope of outages among Internet Service Providers - hovering around 30 minutes during the week.

Over the week, ThousandEyes said a “huge spike” in network outages occurred among collaboration app providers, such as Zoom and Webex, increasing by more than 500% in the US. However, Cloud providers performed well reporting no outages from the week.

“Our analysis of how the Internet has held up during Covid-19 shows that overall it’s done well,” says Angelique Medina, director, product marketing, ThousandEyes.

“The duration and scope of many of the outages that did take place suggest that they were the result of network operators making changes to optimise performance as traffic levels increased. In the week of April 6, we saw a dramatic drop in US outage events by more than 44%. Given that traffic volume has plateaued, we very well may be looking at a return to outage levels seen before Covid-19,” Medina adds.

The following graph includes outages across ISPs, public cloud providers, UCaaS providers and edge service networks (CDNs, DNS, SECaas) between March 9 and April 10

SUNDAYS: A global look

Sunday, March 15

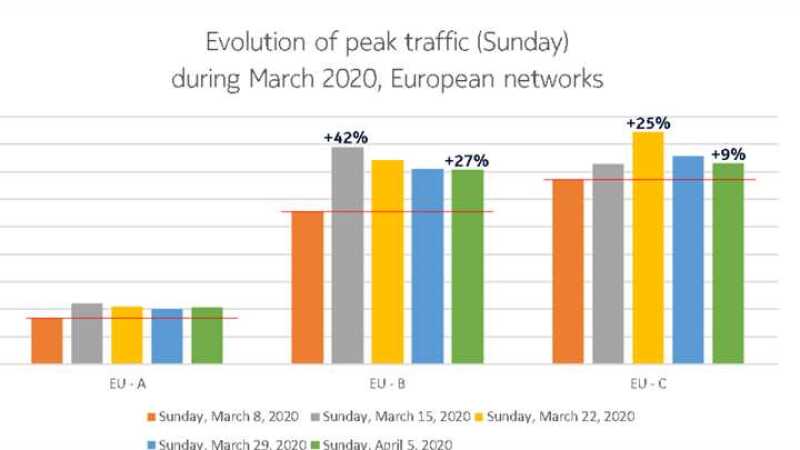

In Europe, especially for operators in country lockdowns, regular previous Sunday peak traffic (March 8) was exceeded by over 30% or even over 40%. This day marked 10 days since Italy first started to quarantine towns in the country’s north, and it also marked the first day of Germany’s lockdown.

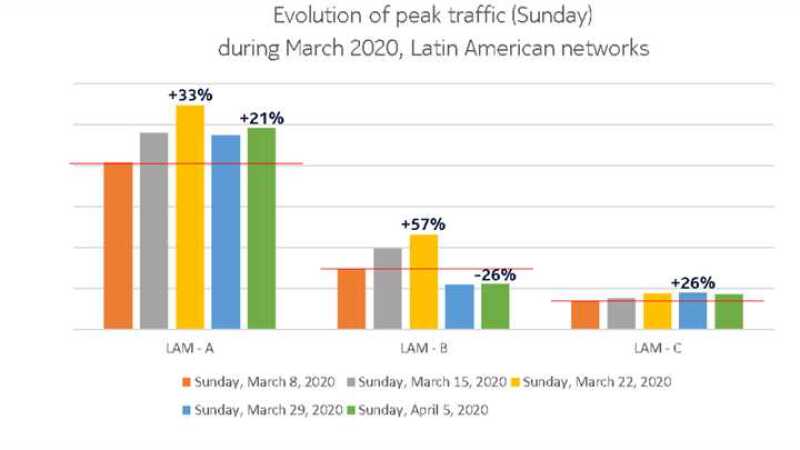

The situation in Latin America showed a wider distribution – from small increases to those over 30%.

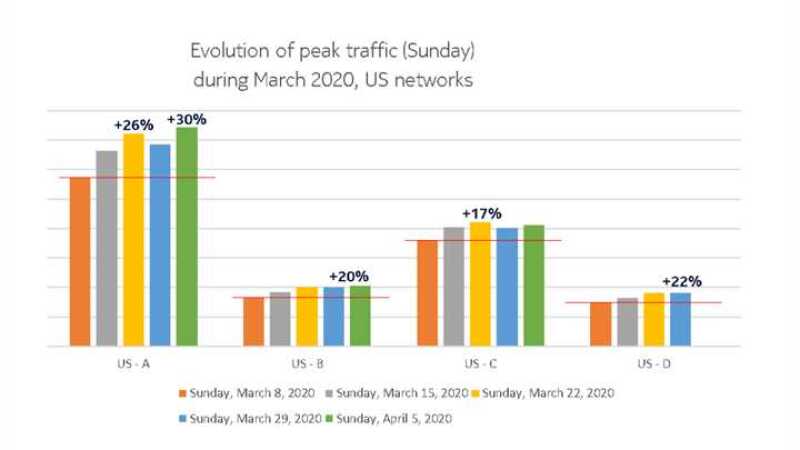

In the US, operators recorded a week on week traffic increase of 7% to 15%.

Sunday, March 22

On Sunday March 22, significant Sunday peak traffic increases were recorded everywhere, with volumes in Latin America rising substantially (versus their ‘normal’ values on March 8). In some cases, traffic increases exceeded 50%. There, lockdowns started to come into effect on March 17 (Peru and Venezuela) with Argentina implementing measures on March 20.

In Europe traffic increases over their ‘normal’ values (March 8) were in the 20%-30% range. However, it turns out that a few networks (in countries affected by lockdowns) saw overall traffic drops between 5% and 7% compared to the Sunday, March 15.

April 5

Despite global traffic rates starting to slow, most recent weekend peak traffic volumes remained at least 20%-30% over pre-pandemic values.