Telepresence is a technology seemingly tailor made for a global recession. It offers the benefits of high-definition audio and video and the opportunity to connect in real time, while reducing the need for confusing conference calls and expensive air miles.

Analysts agree that the growth curve for telepresence will accelerate. Gartner estimates that the global market for telepresence endpoints will grow at a compounded annual rate of 25.7% between 2008 and 2013. However, this growth is from a very low base. Market leader Cisco, for example, currently claims to provide only 4,000 telepresence endpoints.

Dominic Dodd, principal analyst at Frost & Sullivan, has been following telepresence for several years. After 25 years of disappointment with video conferencing technology, Dodd attributes the recent interest in telepresence to marketing campaigns by rival vendors Cisco and HP. Cisco already has 60% of the telepresence market, and has recently strengthened its position with the acquisition of Tandberg. “The perception in the boardroom that video could be a reliable tool had fallen away a bit,” says Dodd. “But developments have very successfully reawakened the sense of potential offered by this technology.”

“We are now on to the fifth generation of telepresence technology,” Dodd explains. “Generally speaking, the network is far more reliable and the cost of high-definition video conferencing is falling dramatically. Now the sheer usability of the system allows you to hold a three, four or five-hour meeting without the fatigue that you get from standard video conferencing.”

Effortlessness costs money

Achieving that effortlessness takes care and costs money, however. Telepresence rooms are designed to an exact configuration, using details such as the acoustic properties of the room and the paint on the walls to create the illusion of a virtual conference table. A full-specification room uses an 18Mbit low-latency, jitterfree, lossless data connection, and can cost hundreds of thousands of dollars to build. Between 80% and 90% of Cisco customer calls are still intra-company. There are very few businesses which are prepared to make this type of investment and to pay for the running costs to enhance communication between company offices.

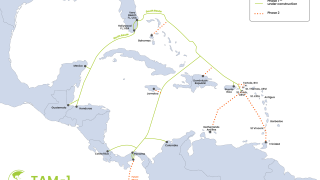

“The early adopters of telepresence didn’t care about the cost of the network, because it offered such a lot of value,” Dodd says. “When carriers were setting up rooms with an 18Mbit endpoint requirement, they faced a market with other concerns than pure cost. Now companies want to extend their networks into more destinations, particularly Russia, India, Asia and parts of Africa. They are finding that these parts are still very expensive to reach.”

The vendors want to reach these destinations, but they can’t do it without carrier expertise and co-operation. “Cisco is playing a major part in this expansion,” says Dodd, “but ultimately only network operators have the necessary experience and the expertise. That could mean a shift in emphasis away from vendors towards network providers and systems integrators.”

Carrier partnerships

The installation process comes at the end of what is probably a year-long sales cycle, and Cisco UK’s head of telepresence, Sarah Eccleston, explains that it relies heavily on carrier partnerships. Telepresence vendors talk a lot about Metcalfe’s Law – that the value of a network increases exponentially as more nodes are attached to it. The interoperability of internetwork quality of service (QoS) is still a problem, though. Vendors and carriers will need to co-operate so that enterprises can communicate with each other, from carrier to carrier. There is no global directory service and no presence information, even for users of the same vendor’s system on a different carrier’s network. There is rarely a QoS guarantee when interconnects are involved. Also, each telepresence vendor positions its cameras and designs its rooms differently, destroying the illusion of a shared room.

This explains Cisco’s desire to recruit more carrier reseller partners to add to its 11 existing partners, and to encourage them to make bilateral agreements between themselves. Tata, BT and Telefonica have interconnection that will provide QoS and presence; others, at the moment, do not. “We can put a point of interconnection in, but it’s not seamless and there is no directory service. We’re working with our largest service providers to offer that,” says Eccleston. “It’s the last step we really need.”

Peter Quinlan, Tata Communications’ vice president of managed telepresence services, doesn’t want to stop at a few bilateral deals. “We don’t get through the sales cycle without answering the question, ‘Who can I call?’” Quinlan says. “If customers can only call the endpoints on their own networks, obviously that’s unsatisfactory. The end game for us is to have a model similar to voice wholesale. We want to be the party that does the interconnect. The endpoint is Cisco’s business, but we are device agnostic. The vendor brand isn’t important – what’s important for the user is the variety of endpoints and the quality of the managed service.”

Sales strategies

This final step will help to unlock the demand that Tata has seen from businesses with high-value clients and suppliers who want to share a connection. Global law firms and the auto, gas and oil businesses are prime candidates to adopt and benefit from telepresence. But Quinlan is frustrated that it is still unclear exactly who customers can call. “Interoperability is ‘sort of, if you know how’ at the moment,” he says.

One way to answer the question more precisely is to sell single-vendor telepresence into vertical markets. That structure is favoured by Global Crossing, which has chosen Teliris as a vendor partner, partly because Teliris has used Global Crossing as its backbone provider for many years. Teliris is well-embedded in the pharmaceutical sector, for example, with customers such as GlaxoSmithKline and Merck.

Frank Piotrowski, senior product manager at Global Crossing, has trained his sales teams to show how telepresence produces a return on investment for particular vertical applications. “Telepresence has a long, long sales cycle. We are installing a couple of telepresence rooms this year, and five to 10 next year. After that, I predict exponential growth,” he says.

There is a need for greater flexibility, however. Not all customers want a fullscale six screen room, and customers with many locations also want to be more flexible over set-up and running costs. “With some carriers you sign on the dotted line as a customer and then you get your network path assessment,” says Piotrowski. “This tells you that you need to change your cabling or install GigE uplinks, or that your router is four years old and doesn’t meet the mark. As a customer you didn’t plan to spend this money, and you didn’t go to the CFO to ask for it.”

Developments are making this technology more broadly accessible, however. “We are lowering costs for single-screen solutions down to the $20,000 level, and suddenly they are affordable for the mid-market tier. Three or four years ago, they were only relevant to the Fortune 500,” Piotrowski says. Also, branch offices can use Scalable Video Coding (SVC) to install a single-screen “telepresence lite” type application, which delivers acceptable quality using the public internet and without expensive QoS. According to Piotrowski, these changes will help to break down the problems of installing inter-company systems and shorten sales cycles.

Specialist carriers

While global carriers see telepresence as an extension of their existing expertise, whether through the reach of the network, vertical sales or existing relationships with global enterprise customers, some specialist carriers are using their telepresence expertise to create an overlay network which may one day be integrated with, or even replace, the existing data network. For these customers, video is a separate application to standard network traffic.

“We have some customers who are deploying a separate video overlay because they don’t want video traffic flowing over the corporate LAN environment. That’s fine, but it slows the return on investment,” says John Dumbleton, UK managing director for specialist carrier Masergy. “We compete with AT&T, BT and Verizon, day in and day out. It’s less about selling more bandwidth; it’s more about high-quality and better bandwidth. You need 100% packet delivery, in sequence. You need jitter to be sub-1ms and low latency, so we provide the global infrastructure, visibility and control. For example, our customers can increase or decrease their bandwidth in 60 seconds.”

Anticipating the potential of this wave of video communication, Masergy has put effort and resources into developing ways for its customers to interconnect. But that too has its problems. “We aggressively pursue B2B opportunities. If that means connecting a Masergy network to AT&T, for example, we have the means to do so but it tends to be costly. An exchange provider will bill between $1 and $3 per screen per minute,” Dumbleton explains.

Managed services

Anil Balani, senior vice president, product development at Glowpoint, hopes to solve the problems of interconnection, high set-up costs and vendor interoperability by offering video communications, from telepresence to desktop, as a generic service to smaller carriers which they can then rebrand and market as their own product. “We’re vendor and network agnostic,” says Balani. “We have been in the business for the last 10 years, and now offer cloud-based services for telepresence. We position Glowpoint as a video add-on, offering this to enterprise customers through service providers who may not have the video expertise. We want to help customers expand outside the corporate network, to partners, suppliers and even telecommuters.”

Rather than concentrating on intracompany telepresence rooms, Glowpoint offers a range of managed services from the desktop to public rooms, managing the interconnect between carriers and interoperability between vendors as the value of the service. It has 800 customers in 37 countries, with a directory, presence information and a custom-built interface that is designed to eliminate the need for support at every location.

“I don’t see one style of video communication dominating,” says Balani. “The key is to make it easy. It has always been difficult and required a dedicated staff to make it work. Now I don’t need an operator or need to change my user behaviour.”

Glowpoint prefers to be a service provider to carrier partners, who share the directory information. “We want to be the ‘Intel Inside’ and help the carriers who haven’t invested in video yet. Now they can offer the full service and the learning curve, which isn’t just about technology. We can offer help on how they should be positioning telepresence,” says Balani. Ultimately, he believes that expertise across the full range of video applications will be more important than the immediate but limited opportunity of telepresence: “Video drives bandwidth for the carrier, but more importantly it also drives stickiness for the carrier.”