|

Even the smallest European economy boasts its own incumbent telecommunications company, each with its own strategic priorities and world view and facing its own mix of competitors. What all of these telcos have in common is the need to drive an increasing proportion of income from investment in other parts of the world, both in order to satisfy major enterprise customers seeking global reach and to offset the difficulties of profiting from a tough and largely saturated domestic scene. Yet each of the European telcos approaches this imperative in a unique way.

We may though be nearing the end of an era in which major European operators can assume the easy right to plough their own idiosyncratic furrow in a succession of foreign markets. The cosy post-colonial sense of entitlement that has buoyed the land-grabbing of the past few years seems out of place in the face of an increasingly diverse global marketplace. The market that these players are vying for a stake in is changing fast. To address international opportunities, Europe’s big telco names now need to compete not only with each other, but with those ambitious players from other continents who are fired by a similar hunger.

They must also find their way in a world transitioning from legacy standards to next generation ones, while moving on from the comfort zone of revenue sources they know well to embrace new service areas that in some cases they are ill-equipped to exploit. So against this background, which European players, if any, look set to be the global success stories of tomorrow? Will it be the same names that have been making the weather over the last decade? Who indeed are the true successes of the last decade?

Going global

“It depends a bit on what you’re measuring, but I’d identify Telefónica, Vodafone and France Telecom Orange as the most globally pervasive European players at present,” says Emeka Obiodu, senior analyst from analyst firm Ovum’s telco strategy practice. “You can perhaps add in TeliaSonera and T-Mobile too.”

Telefónica, points out Obiodu, remains mostly focussed on Latin America for its non-domestic revenue: “It has no presence in, say, Africa at all,” he says. “It works with a few major enterprise customers in Asia-Pacific, and has a minority stake in China. Orange on the other hand has presence across Europe, Africa and the Middle East. It’s moved way outside its Francophone comfort zone, and is now interesting itself in a number of new markets. I think it has recognised that the future of the world is likely to be more Anglophonic than French-speaking, forcing it beyond what it knows best.”

Of the major mobile brands, Vodafone, he says, remains preoccupied with countries that have English as their main language: “T-Mobile for its part has now retreated from the US market, and is focussed on a more familiar footprint. TeliaSonera is looking close to home – at Scandinavia and the former eastern bloc.”

Wholesale changes

Chris Lewis, group VP for international telecoms with analyst firm IDC, says Europe’s major telcos are having to weigh up whether their global presence is slanted towards wholesale business, or whether it is primarily concerned with satisfying the needs of their multinational corporate customer base – the third option being a mix of the two disciplines, one cross-pollinating the other.

“The international wholesale strategies of players like France Telecom and Deutsche Telekom largely have the purpose of supporting their international enterprise business,” he observes. “It’s different to India, say, where the major players are really going for wholesale business in a big way, by acquiring companies like Tyco and so on.”

UK incumbent BT, believes Lewis, is in a different category: “In many ways BT is ahead of other European incumbents in its thinking on what international wholesale is.”

Stephan Deutsch is head of marketing for Global Telecom Markets, a division of BT Global Services that specialises in international wholesale.

“We leverage BT’s wider expertise to offer customers a global approach that takes care of local requirements,” he explains. “Our services are end to end, based on what capabilities there are on the ground, which naturally differs from market to market. In some places we’ve got a strong local footprint so we can replicate our whole service range, while in others we’re limited to working with partners.”

He says the aim of Global Telecom Markets is always to be the customer’s wholesale partner of choice: “Not buying from us because we’re the only option but because our offer is the best,” he says. “We’ve learned from the competitive UK market that customers buy most when you offer the best option, not the only option. We in turn help wholesale customers manage their customers better, innovating more quickly with less risk.”

Services, he says, range from traditional voice and data to what he calls “supporting customers on their journey to IP”.

“We offer lots of data services for the mobile market, for example, and can work with customers towards IP at their own pace,” he claims. “We wrap it up with our services so they can choose from a bundle of value and volume. These days there’s lots of markets out there, but limited capital to approach them with. This forces service providers to concentrate on certain things themselves. But there’s more they need to offer or customers won’t stay, so they need to be able to take managed services on a white label basis so that they can focus on what’s core.”

He says BT’s international wholesale customer base spans various types of customer: “We work with fixed network operators and mobile operators,” he explains. “We’re not a mobile operator ourselves, so we can offer services to MNOs across the world without being their competitor too. That’s important to them. In Europe, we’ve got service provider customers who need a one-stop shop so they can be a virtual operator without operating their own network at all. And we serve the top global players too who need to complement their service offering with what we do.”

Deutsch perceives that the differentiation between these different customer types is starting to diminish: “In the past there was a huge difference between what an MNO and, say, a calling card company was asking for,” he explains. “They want to use the same network now, and the edges are blurring. Interoperability of networks is in demand now.”

The search for new strategies

If one considers the international achievements of Europe’s big names in the enterprise rather than the wholesale sphere, then one player is rapidly consolidating its lead over all others, believes IDC’s Lewis.

“For sure, all the major European players have very different international strategies for MNCs,” he says. “But the one with the longest standing international credentials is surely France Telecom. It’s made acquisitions over the years, like Equant, now Orange Business Services. Through its strategy, it has achieved the broadest base of customers of all its peers. BT on the other hand, starting under Ben Verwaayen, went after the IP side, and for acquiring a number of companies to give them a localised presence. They’ve been pushing after a lot of IT and well as just communications business.”

Deutsche Telekom for its part, says Lewis, has built fairly successfully on its German base: “The other big one is Telefónica,” he believes. “Its properties in Europe and internationally give it a dramatically different footprint to the others. Creating this sort of regional overlay is difficult, but they’re giving it their best shot. Telecom Italia has chosen to address multinational business through its Sparkle division. But they’re not really tripping off my tongue as one of the major European players. BICS is a big wholesale player, but likewise isn’t on my list of top MNC providers. TeliaSonera is likewise low key on the MNC front, but has gone for an interesting borderless networking approach regionally, around the Baltic.”

Mark Kenealy, managing director UK and Ireland for Orange Business Services, offers his take on the company’s strategic priorities for international enterprise business: “Our global network extends to 160 countries, allowing us to offer services to all kinds of multinational enterprise,” he says.

“It’s an MPLS network – solid and reliable. Our investment in places like Africa started well before the rest of the world started to take notice. We’re focussing on a lot of different African markets, like Angola which has just started to get hot.”

Kenealy, who joined OBS in 2010, describes his background as ‘managed services’: “This is why I’ve been brought into the company,” he says. “We’re focussing on delivering the right service for the appropriate place – the right size of service for the right use. That’s got to mean IT services too, so you can deliver an ‘office in a box’.”

Extending services into new markets where one does not enjoy the status of a well recognised brand inevitably throws up difficulties which some seem better equipped to surmount than others, believes Kenealy: “If you look at North American carriers, like AT&T and Verizon, they are getting more aggressive about worldwide business, although they are generally struggling to deliver exactly what they do in the US,” he says. “You can get in a mess in a new market. We’ve been in places like Brazil and Russia for ages, and we know how the system works.”

About 93% of the turnover of Kenealy’s UK arm of OBS is international, he says: “The UK market is likely to grow 1% this year, as is much of Europe,” he adds. “We grew 18% last year. The future is going to be consolidating in developed markets, and looking for

where you can roll out your business in emerging markets.”

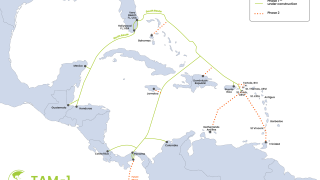

BT, says Deutsch, is keen to emulate this cosmopolitian approach, and has been honing its offer for new, under-served markets: “We’ve got a growing focus on emerging markets,” he says. “We’ve recently made a push in Asia-Pacific, for example. At GTM, we are benefitting from BT’s wider programme of investment, with investment into subsea cables to help customers benefit too. It’s about allowing operators to build relationships over a federation of hubs.

Securing future services

The obvious drawback of a strategic focus on exploiting new and emerging market opportunities, says Ovum’s Obiodu, is that a finite wellspring of such things exists. It’s a well he fears is running dry.

“It sounds so appetising to talk up ‘opportunities for service growth in emerging markets’,” he warns. “But by now most major multinationals have their ICT needs in these markets taken care of. I think it’s time for Europe’s telcos to scale down their ambitions to sell into new emerging markets and instead look for localised partnerships in the markets they already serve to see how they can do it better there. There’s really nowhere left they can go into with a swagger and a smile and cream it all off. The low hanging fruit is already plucked, and you’re better off extending vertically into places where you are already. The land grab era is over.”

Deutsch agrees that true future potential for the big telecoms players lies in the service arena, and in the quality and depth of a services offer: “Who’ll succeed in the future?” he ponders. “Those that offer true network interoperability. Wholesale is, as it’s always been, driven by corporate and retail trends. One of those is the cloud, so there’s a future where lots of applications all need to go to the core of the network. Successful telcos will also offer managed services and the benefits of a network of local partners to their wholesale customers.”

OBS’s Kenealy says the company is also setting future store by moving deeper into the ICT services zone: “We’re building six data centres across the world to help us deliver cloud services,” he says. “There’s a lot of people talking about their cloud strategy, but not all have infrastructure that you can see and touch. To make cloud work you need the pipes, and you need data centres with storage, all connected with virtualisation technology.”

IDC’s Lewis believes it is time for Europe’s telcos to ask themselves important questions about what it takes to prosper in this new environment of ICT services delivered on a global basis: “If cloud is done properly then anyone can be a service provider, as the building blocks fit together easily,” he posits. “This raises interesting questions about exactly what a service provider is. I think the market for ICT services is now being reshaped for the future. How much centralised knowledge do you need versus local support? The ability to be local and global at the same time is going to be key in future.”

Ultimately, says Lewis, the actual service being delivered must be local: “The other challenge is building into vertical markets, financial services being one that everyone is into. Other telcos often focus on ones that have a relationship with their home market – for example automotive in Germany. In the ecosystem of the future, not everyone can be an expert in everything. Choices must be faced.”