Enterprises wanting flexible and scalable access to compute resources, without either breaking the bank or sacrificing too much control, are turning in large numbers to a hybrid cloud model.

Many of the efficiencies of an on-demand application model can be enjoyed by organisations who choose to operate their own private cloud server. By tweaking and adapting their server infrastructure they find they can enjoy a satisfactory balance of freedom and control over resources. But when it comes time to scale those resources up, it can help to blend the use of their private cloud with public cloud services, as operated by the likes of Microsoft, AWS or Google. It may indeed suit them to go beyond a simple hybrid cloud model and use a mix of different cloud services from different providers, according to what they see as the strengths of each, while still retaining their own infrastructure for particular roles.

“Operating on a hybrid basis enables businesses to take advantage of the collaborative working capabilities offered by the likes of Office 365 and G-Suite, while securing sensitive HR or financial data that must be kept on-site,” points out Steve Foster, senior solutions engineering manager UK and Ireland with Riverbed Technology, a vendor of application performance solutions.

Connectivity is central

This ability to have multiple cakes and eat them too explains why the hybrid model is soaring in popularity. Research firm Markets and Markets predicts that the market will globally be worth $91.74bn by 2021, up from £33.28bn in 2016.

Connectivity has always been a central part of a successful cloud strategy. Never more so, as the cloud market becomes more complex and nuanced, argues Mark Scaife, head of cloud practice at UK-based service provider Daisy Group: “Carriers play a pivotal role in cloud adoption,” he says. “One of the biggest inhibitors to large scale adoption of cloud services is the connectivity between A and B. While public cloud adoption is increasing at a rapid pace, businesses are still hamstrung by compliance and regulatory constraints along with amortised assets or legacy solutions sitting in datacentres, which is the perfect storm for hybrid cloud adoption. Connectivity is the glue that bonds these together and ensures a smooth onramp to cloud, hence the necessity and collaboration between carriers and cloud solutions.”

Rick Moore, global director, cloud strategy at data centre operator Digital Realty, believes that enterprises are getting more savvy about how to get the best from a cloud investment and see carrier connectivity as more central to that than ever: “Businesses are smarter about where their cloud resources actually sit, and about how they architect their data centre topology and networking strategy around high performance, high security connections into those resources,” he believes. “A couple of years ago, at the beginning of cloud 2.0, when enterprises were migrating workloads and applications, not a lot of though was being given to where those cloud resources sat or about specific latency requirements. We were all thinking more about physical security at the time. Now people are thinking again and realising that some public cloud resources can sit in a multi-regional environment and satisfy certain perhaps not very demanding performance requirements. Other workloads are demanding not only milliseconds of latency performance but in some cases microseconds. People are getting wiser about where resources sit so they can connect to them and meet certain performance and latency requirements.”

Moore sees the software enabling of so many carrier networks as playing very well in this scenario: “SDN enables the performance we’re talking about, plus it is starting to make things really simple,” he explains. “It’s getting easier to peg yourself to an underlying cloud resource, plus more services are available. And as the industry continues to consolidate, for example with Level 3 and CenturyLink, you are getting some really powerful networks emerge. That’s great for cloud.”

Moore says a crucial benefit of SDN is to allow for a standardisation of network services to become possible for the first time. “You’ve got a network provider who can come in and make it so ordering a VLAN to my cloud services in Australia is as simple as it is in New York or Singapore. It’s confusing and time consuming to order services in one part of the world and have to start over in another part of the world. Network providers are needed who can address that by moving along the SDN front. Delivering simplicity is our job too.”

Moore foresees a more consolidated and collaborative hybrid market developing over the next three years: “You’re already seeing partnerships between players like AWS and VMWare, and Microsoft talking to Dell EMC about its Azure Stack. There’s an opportunity for carriers to become part of those solutions. We’re certainly going to see more bundled and packaged solutions in the cloud market.”

But there is transformative work to be done first, and certain carrier names are determined to be in the vanguard of a more flexible and more aggressively direct approach: “Carrier focus to date has been on supplying the big content players,” says Mattias Fridstrom, Telia Carrier’s chief evangelist. “Carriers have the connectivity into the cloud – the Googles and the Amazons – so why not use that and go to enterprises direct and sell them this connectivity, and more besides?”

He says Telia has had to undergo significant reinvention to address this opportunity: “It was easier when it was just a matter of supplying point to point solutions, but now we are offering so much more a lot of time is being spent on enhancing systems and building IT resources to become a much easier company to work with so people will want to buy everything from us,” he says. “We have all the pieces – the public Internet, the private network, the dedicated circuits – we just need to make sure customers can easily select what they want.”

Going beyond wholesale

Wilfred Kwan, COO of Global Cloud Xchange (GCX), is similarly excited about the hybrid cloud opportunity: “The problem for enterprises often is that they have too many cloud options on the table and they don’t know which one to pick,” he observes. “We’re used to picking the right solutions for our customers. It’s nothing new to us. We’re often approached by enterprise CIOs or COOs who want to test out new ideas, which we are more than happy to do for them.”

Traditionally, the wholesale carriers communit has not been used to providing a customised solution: “If you want to capture the cloud market, you have to have the big muscle and the big pipes, but at the same time you’ve got to have the project management team than can handle the variance that the customer needs,” he explains. “That means a lot more work of course, and a lot more technology you need to understand. Along with that added work comes a lot more stickiness.”

Jerzy Szlosarek, CEO of Epsilon, believes it is vital for carriers to go well beyond a traditional wholesale approach to maximise the hybrid opportunity: “Legacy networking models are too slow and inefficient to support a hybrid cloud,” he believes. “They add complexity instead of removing it while increasing costs. Connectivity is critical to any hybrid cloud strategy and enterprises want simple networking solutions that mirror the agility and adaptability of the cloud. The best way for a service provider to support hybrid cloud is to deploy an on-demand connectivity platform, like our Infiny, with its direct access to multiple CSPs.”

Through a single connection, he says, they are given the control and the freedom to adopt more cloud services and use whatever infrastructure best suits their objective: “Connectivity is managed from a single platform and they aren’t paying for or managing multiple direct connections,” he adds.

John English, senior manager service provider solutions at network performance solutions firm NetScout, believes better network visibility is crucial for carriers with cloud ambitions: “To maintain a competitive edge, carriers must ensure they have actionable intelligence based on comprehensive visibility across their entire infrastructure, including all on-premise, wide area networks, and off-premise cloud environments, for full service assurance,” he says. “End-to-end visibility will therefore be required across the increasing amount of data travelling back and forth in traditional on-premise and multi-cloud environments.”

Profound transformation

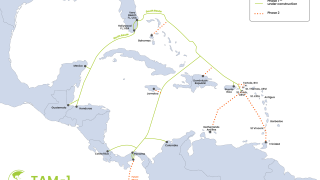

Not every carrier, however, has the horsepower to make hybrid cloud work, certainly not solo. The model of connecting organisations with legacy IT hosted in their private data centres as well as assets hosted in multiple public clouds requires a connectivity proposition with reach and density.

“This means not only connecting branch offices to each other globally, with availability and reliability that supports customers’ strategy and growth ambitions, but also providing connectivity into the mission critical digital ecosystem that lives in the cloud,” believes Andrew Edison, vice president of wholesale at Colt. “No one network can cover the entire globe so there is an extensive reliance on other carriers to fill in the missing pieces in the coverage map. As a result, networks will buy connectivity and capacity from each other in varying quantities.”

Increasingly, he observes, data centre operators are also becoming resellers of connectivity, as enterprise customers buying cloud services also need access to those facilities: “In fact the biggest area of growth in terms of connectivity right now is data centre to data centre interconnection,” he points out.

The transformation that carriers must undergo to meet the hybrid cloud market head on is as profound as it is beneficial, argues Iain Harfield, senior presales consultant at Tibco Software: “This changing business model for telco and specialist wholesale will reverse their down turn,” he says.

“A focussed wholesale organisation will be fundamental to delivering network capacity for ‘anyone to anything’ in an agile manner. However, connectivity and capacity is not enough. A successful transformation must be accompanied by differentiating value added services. Future wholesale providers will be able to supply more traffic distribution use cases, on-demand and at scale.”