Adel Hamed, Telecom Egypt’s chief international and wholesale officer, became CEO of the group in February, in succession to Ahmed El Beheiry.

In the consumer market, Telecom Egypt (TE) now has a licence to deliver IPTV and “we aim to expand our product portfolio to become a quad-play operator”, he says.

“We also aim to launch our mobile wallet in 2019 to take our first steps in mobile financial services.”

When Hamed was appointed the company made much of the Egyptian government’s plan to speed up the national digital transformation initiative, and it linked this to the company’s own digital transformation plans.

“Digital transformation for us is a major priority and relates to our domestic as well as our international business,” says Hamed. “Locally, we aim to support the government’s initiative for digital transformation, which entails connecting governmental institutions across Egypt to enable economic reform.” Work has already started on connecting up schools, “and we have a line-up of projects to work on in 2019”.

Internationally, TE wants to expand the reach of its cables, following on from Hamed’s on work in his previous role.

“We are also expanding the diversity of the international routes across Egypt to attract new cable consortiums,” he says.

Meanwhile Telecom Egypt has quietly adopted a new brand, WE. Look on the website, and you’ll read about WE internet services as well as WE Ardy – a fixed voice service – and WE mobile packages.

“Our commercial strategy entails delivering all our customers’ needs under one monolithic brand, WE,” says Hamed, “capitalising on our leadership in the homes of customers while delivering a premium customer experience. As of 2018, WE’s fixed voice customers grew to 7.9 million, of whom 5.2 million enjoyed fixed broadband connectivity, while mobile customers reached 3.9 million.”

Both mobile and fixed data “are underpenetrated” in Egypt, he says, reaching only 39% of individuals and 27% of households. “This presents an opportunity for Telecom Egypt, especially in light of Egypt’s favourable demographics with 61% of population below 30 years and around two million entering the market annually.”

Last year the company launched new and revamped existing products, and launched an integrated bundle of mobile and fixed voice plus data under the name Indigo Plus.

“The WE portfolio is not complete yet,” says Hamed. The target is “to go beyond connectivity into providing content as well as tap into mobile financial services”. As a start WE struck a partnership deal with Sony PlayStation to offer content-based solutions. This was “the first time” in the Middle East, North Africa region, he adds. “With our nationwide IPTV licence in hand, we also intend to offer our customers a quad-play offering in 2019”, to increase its entertainment offer.

TE began to replace copper with fibre back in 2012. “By the end of 2018, 70% of the replacement programme was complete we aim to reach 100% by 2020,” he says.

But the digital transformation initiative is surely part of that? “Digital transformation is a key pillar and enabler of Egypt’s sustainable development strategy, Egypt Vision 2030,” he says. “The aim is to harness the power of digital technology in order to accelerate development and improve the lives of Egyptians by modernising the economy.”

TE is working closely with the Ministry of Communications and Information Technology (MCIT), he says. “Our strategy entails building digital infrastructure, and this starts with higher speed fixed and mobile broadband to all our consumer, enterprise and government customers and moves on to include data centres, cloud, platforms, and finally, applications.”

TE is working with other operators, and he lists systems integrators, government bodies, start-ups, developers, cloud providers, OTT providers and multinational enterprises.

“The deployment of fibre infrastructure provides connectivity with superior quality.” This will enable the provision of advanced applications to support the country’s development goals, he says, and a climate that’s attracting foreign direct investment.

“In 2018, we have connected 2,530 schools with fibre.” This was part of a project with the Ministry of Education to reform education. “We have also signed a protocol with the MCIT to provision fibre optic infrastructure to all government bodies across the country starting with the city of Port Said as a pilot, which we have completed in the first quarter of 2019.”

TE has set up a number of relationships with other companies. What’s the aim of the recent agreement with Vodafone Egypt and how does it fit in the company strategy? “Our success in the wholesale segment relies on our relationships with domestic and international carriers and customers,” says Hamed.

“The business model is characterised by signing long-term agreements. The domestic wholesale business unit offers local ISPs and mobile operators infrastructure, transmission and access services.”

TE has leased infrastructure to other operators in Egypt since 2009, he notes. “Telecom Egypt has continuously offered them a more viable economic model. Such models were developed to secure Telecom Egypt’s domestic revenue stream and its leadership in the market for the long-term.” And that business has grown TE’s infrastructure revenue.

“As for the agreement with Vodafone Egypt,” he continues, “we signed in February 2019 two ten-year transmission and infrastructure agreements.” These were worth a total of 10.85 billion Egyptian pounds ($626 million). One covers Vodafone Egypt’s current and future requirements for domestic transmission services for both fixed and mobile, and the other “represents a new cooperation between the two companies”, with TE providing fibre backhaul to Vodafone. “The tenure of the agreements proves that we are the partner of choice for domestic mobile operators,” he adds.

This new pair of agreements follows on from a long-term agreement with Orange’s Egyptian business and a framework agreement with Etisalat Misr.

“That said, operators continuously need to invest and expand their networks to meet the growing demand for data driven by the boom in the consumption of content,” he notes. “Over the past five years TE has developed various products for domestic operators, encouraging the growth in internet and data services by developing its product offering from physical legacy connectivity to speed-based broadband services.” It has moved to consumption based charging – bulk bitstream.

“We have also developed enhanced solutions and symmetrical high-speed digital subscriber line services for the enterprise customers of operators,” he adds.

On top of that TE signed a deal with Microsoft for cloud services. Why Microsoft rather than any other cloud company? “The collaboration will increase Microsoft’s reach to the large Egyptian market in addition to improving connectivity across North Africa and the Middle East,” says Hamed. Services will include international marine connectivity, he adds, “capitalising on Telecom Egypt’s huge investments in the submarine infrastructure”. And the company will provide hosting services to Microsoft’s global network, for services including Bing, Office 365, Microsoft Azure and Xbox Live.

“This agreement is one of Telecom Egypt’s first steps towards its vision of turning Egypt into a digital hub and we are looking to expand this business line further,” he adds. “Our geographical position and digital infrastructure will enable major cloud providers such as Microsoft to enhance their reach to consumers and enterprises in Egypt as well as reach other markets.”

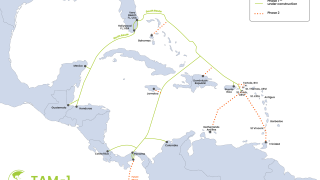

Hamed explains that TE’s global network “was built over the years through investments in international submarine cable systems with consortiums and in privately owned cable systems”. Ten years ago, there were six submarine cables landing in Egypt with two landing stations. “Today, Telecom Egypt has 13 submarine cable systems landing in six landing points in Egypt, 11 of which are crossing Egypt over seven diverse routes.”

There are new submarine cable projects in the pipeline, he adds. “Three new landing points and new trans-Egypt routes are in the plan to provide more diversity and resiliency to our network.” Two landing points will be on Mediterranean Sea, one of which is already built in Sidi Krir, while the other point will be further east and designed to cater for the requirements of large OTTs.

“A new site on the Red Sea, further south from the current Zafarana landing station, is also being planned. This landing point is characterised by its remoteness from the busy marine activities and the Suez Gulf’s shallow waters and it will be economically attractive for new subsea business cases.”

In addition, TE is planning new terrestrial routes connecting existing and new landing stations – such as the one that will be extended along the north coast of Egypt.