The figures, calculated by Dell-Oro Group, accounted for activity in broadband access, microwave and optical transport, mobile core, RAN, SP Router and CE switch. However, not all segments registered strong performance.

For example, mid-single digit growth in optical transport and RAN offset weaker demand for microwave transport and broadband access equipment. The two largest equipment markets were mobile RAN and optical transport, which when combined accounted for approximately 55% of the overall telecom equipment market.

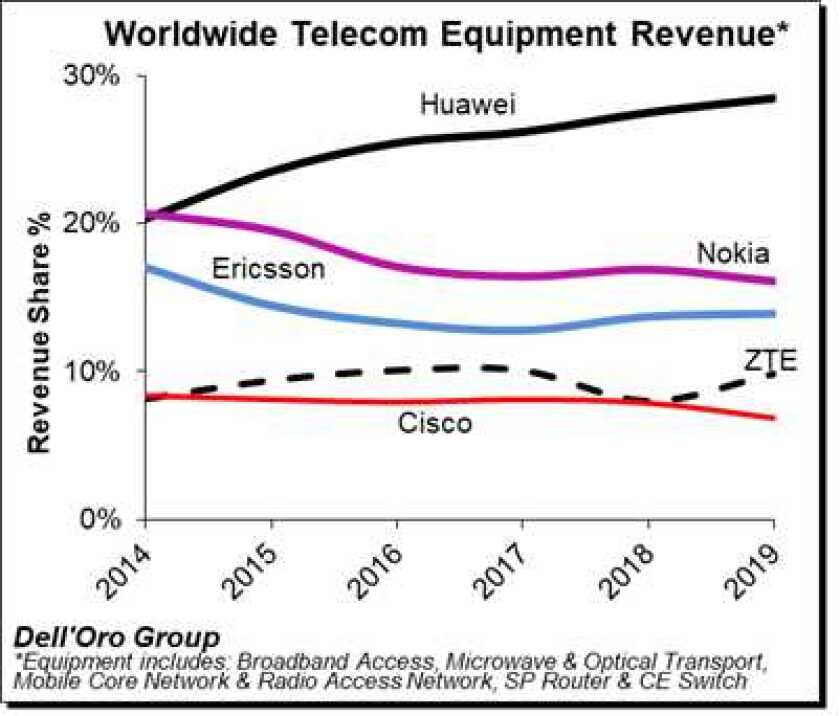

In terms of revenue share among key suppliers, Huawei led the pack, generating 28% of the total market’s revenue for the second consecutive year. It was followed by Nokia at 16% (down 1% on the previous year); Ericsson which maintained the same 14% share as the previous year; ZTE at 10% (up from 8% the previous year); and Cisco at 7% (down from 8% the previous year).

The optimistic results followed three years of total market decline between 2014 and 2017.

Elsewhere in the report 5G RAN growth was responsible for driving overall RAN market growth, while optical transport posted its fifth consecutive year of growth and the highest annual growth rate in a decade.

However, the overall broadband access market saw revenue decline for the fourth consecutive year, despite the growing demand for PON equipment. Doll’Oro attributed this result to the declining investment in cable and DSL.

Chinese equipment

Despite mounting concern from major economies, Chinese equipment manufactures Huawei and ZTE fared well in the results.

The report showed Huawei’s overall telecom equipment share continued to grow over the period, but the pace of its 2019 share growth “was weaker than its average 2014-2019 share growth”. Meanwhile, ZTE saw revenue share improve by about 2 percentage points, “reflecting a robust recovery since the US ban” during the first half of 2018.

With Huawei now out of the 5G race in many major markets, it remains to be seen if these results can be repeated next year.