In the past five years, the international telecoms landscape has changed profoundly, to the point that we need to expand the notion of wholesale to global solutions. The legacy businesses, such as voice and roaming, are highly mature and affected by OTTs and regulations. The capacity business has become the key driver, spurred by growing bandwidth needs. Meanwhile, service and asset innovators emerging in the adjacent sectors are making a mark in value creation.

Innovation in international telecoms

From one side, investors’ interests have shifted towards heavy infrastructure-based models or digital cloud-based platforms that can directly address multinational enterprises from cross-border positions. From the other side, a paradigm shift has shaken up the market from the strategy, product, and operational perspectives. New products have shown high innovation potential, as they are based on transparent, automated, real-time platforms developed at a global scale.

The new product categories are pioneered by non-traditional telecoms players commanding value creation. They offer global platforms that reconstruct core international carrier products, putting digital technology and software at the centre of their proposition. As a result, they scale far better than traditional models. The corresponding revenue generated already exceeds that of the legacy wholesale market, which remains largely non-transparent.

The innovators benefit from positive investor sentiment resulting from the platforms. The market capitalisation of companies that chose to list has reached nearly US$200 billion. Half of this value comes from companies established since 2008 – which is remarkable, as these business segments were created around internet backbones first established by tier 1 international carriers 20 to 25 years ago.

International carriers could have captured these trends earlier and made inroads if their company or telecoms group had better managed fragmentation of operations, presuming they had adopted a purposeful mission towards innovation, and trusted the sector to bring remarkable new opportunities. Instead, many of them remain anchored in past approaches and products, leaving the market open to disruption by new players.

Wholesale consolidation offers short-term cost benefits

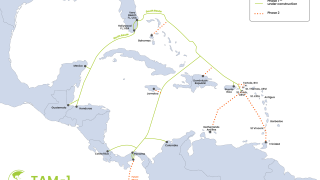

If innovation is too ambitious, wholesale consolidation offers short-term cost benefits. With consolidation, telcos can pool their resources and invest better in infrastructure and/or platforms. The consolidated entity can then offer services to its captive opcos at prices below or on par with the market, maintaining the value within the consolidated entity or among the opcos. Further, the value of these assets increases with the geographical extent of the network. By building a large, interconnected international network, the telco can offer reach to many more locations and promise higher-quality services.

Though wholesale consolidation is understood to bring clear value, it faces a lot of internal resistance. The consolidated entity typically has narrow scope and limited investment power.

The consolidation also faces resistance on governance elements such as the shareholding structure, staff appointments, and value sharing between the parents and opcos. Such resistance has delayed many consolidation initiatives in the past.

What should telcos do?

Telcos and telco groups must focus their attention on innovative mega-infrastructure or internetworking solutions. Shareholders should recognise that their small operations are unfit for the future challenge.

Groups should begin or revive international telecoms initiatives among their opcos, irrespective of past failures. Small stand-alone telcos should look for potential suitors for consolidation or centralised orchestration, based on strategic fit and potential synergies. Telcos should aim to be shareholders rather than customers, if they have ambitions for a significant role in the international business.

Groups should also build a strategy based on investments and innovation. Cost savings can justify the cost of consolidation, but this does not offer a long-term purpose for the wholesale entity. Once the synergies are achieved, the entity will have declining profits owing to hyper-maturity of products. Therefore, the wholesale entity should be based on investments in large capacity and product innovation, and should plan to be sustainable based on third-party revenue in the medium to long term.

Most telecoms’ international initiatives start well, identifying consolidation paths and developing a strategy, but falter in implementation. Strategy does not get beyond the boardroom, because of disagreements on governance. We suggest telcos work on governance principles from the start, securing commitment up front with the right support from a third-party facilitator.

The set-up must be conducive to attracting capital and talent into the industry for investments in new assets and developing new products. In a large telecom’s portfolio, value creation and realisation is the only way to remove any doubt related to new investments or consolidation.