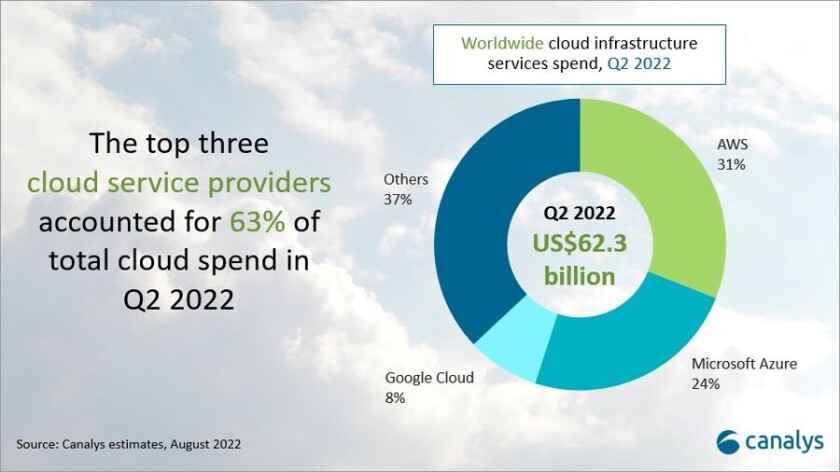

Figures from Canalys (see chart) show that both Google and Azure are growing faster than the industry average, while AWS is tracking the global industry’s growth rate of 33%.

The total global market for cloud services in the second quarter of 2022 was US$62.3 billion, says Canalys in its report.

The market is “driven by a range of factors, including demand for data analytics and machine learning, data centre consolidation, application migration, cloud-native development and service delivery”, says Canalys.

“The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. … In a global economy rife with inflation, rising interest rates and recession, demand for cloud services remains strong.”

In terms of market share, AWS accounted for 31% of total cloud infrastructure services spend in the second quarter of 2022, making it the leading cloud service provider.

Azure was the second largest cloud service provider, with a 24% market share. Google Cloud accounted for a market share of only 8%.

“The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival,” says Canalys.

“Fuelling this growth, Microsoft pointed to a record number of larger multi-year deals in both the $100 million-plus and $1 billion-plus segments.”

The analyst said that “a diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS”.

Canalys VP Alex Smith commented: “Cloud remains the strong growth segment in tech. While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure, said the Canalys report. “AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.”

Smith said: “Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology. This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar.”

Canalys said that, beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys research analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”