The landmark deal marks the first time that a telecoms group in a major European market has offloaded its landline grid.

The sale is part of TIM’s strategy to reduce its debt from €25 billion euros, with the transaction potentially reducing debt by as much as €14 billion.

However media company Vivendi, which owns a 24% stake in TIM has slammed the deal, which was approved by the board 11-3 in a vote.

“Vivendi deeply regrets that TIM’s Board of Directors accepted KKR’s offer to buy TIM’s network without first informing and requesting a vote from its shareholders, thus contravening applicable governance rules,” Vivendi said in a statement.

Vivendi argue that the sale entailed a clear change in TIM’s corporate purpose, and claims that as such an extraordinary shareholder meeting should have been held.

“Telecom Italia shareholders’ rights have been trampled on,” the group went as far to say.

Vivendi have previously expressed concern that the asking price for the grid was too low, and also questioned the validity of TIM’s remaining service business.

Vivendi also wanted clearance from an internal TIM board committee for the related party transaction that arose from the Italian Treasury’s involvement in the deal.

The treasury owns Italy’s state lender CDP, which is TIM’s second largest shareholder. But Prime Minister Giorgia Meloni has already backed the deal and has authorised the treasury to spend up to 2.2 billion euros to take a 20% stake in the network alongside KKR.

“..All appeals to reasonableness having gone unheeded, Vivendi will use any legal means at its disposal to challenge this decision and protect its rights and those of all shareholders,” Vivendi concluded.

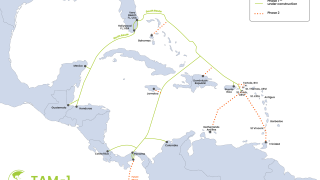

KKR have also made a non-binding offer for TIM’s subsea cable business, Sparkle, but this bid was rejected. A deadline of 5 December has been imposed for KKR to submit a revised bid for Sparkle.