The Department of Telecommunications (DoT) this morning told RCom that it could not sell its spectrum to the unrelated rival Reliance Jio as the proposed deal “does not conform to its guidelines”.

RCom was relying on the money from selling 122.4MHz of spectrum to pay off its debts to Ericsson – which has been threatening to begin a winding-up order if it is not paid.

In early October Ericsson filed a contempt of court petition in India’s Supreme Court against RCom, alleging the company had missed a payment of 5.5 billion rupees ($74.6 million).

Ericsson was still threatening to take action to wind up RCom last week, as RCom itself appealed to the DoT to approve the spectrum sale. RCom missed the final deadline, 15 December, but hoped the Jio money would save it.

RCom went into bankruptcy protection earlier this year because of the Ericsson debt, but exited the process in May after Ericsson agreed to take only 50%.

However, as that was a deal agreed in court, Ericsson is threatening to take contempt of court action against RCom’s owner Anil Ambani. He is the brother of Mukesh Ambani, the owner of Reliance Jio – making this probably the bitterest case of sibling rivalry in business history.

The DoT rejected the spectrum sale because Reliance Jio wanted to be sure it wouldn’t be liable for any of RCom’s unpaid spectrum fees. The DoT said it could not give such an assurance.

Capacity has contacted Bill Barney, CEO of RCom and GCX, and Lorain Wong, the chief marketing officer, for their comments on the situation, but they did not respond.

The DoT’s decision threatens to unravel a whole series of deals that RCom and GCX had planned. First, Jio was due to buy RCom’s towers and its Indian fibre network as well as its spectrum, as RCom has closed its Indian mobile business.

It was also selling unneeded real estate to a Canadian company, Brookfield.

The company was expecting to receive $2.55 billion for all the assets – though some sales have gone ahead and others are still proceeding. However, the spectrum element of the package was crucial. RCom’s total debt was $6.53 billion.

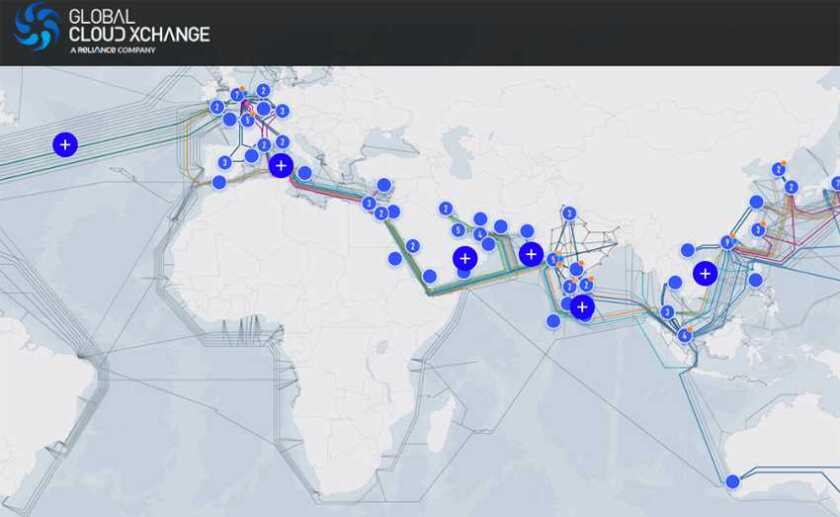

RCom was hoping that, following a successful asset sale, it could then move to the next stage of the process,considering bids for RCom’s data centres and Indian enterprise telecoms operation plus GCX’s subsea business (pictured), including its planned Eagle cable from the Mediterranean and the Middle East to Mumbai and from Mumbai to Singapore and Hong Kong.

Anil Ambani is known to be looking at two bids for the GCX/data centre/enterprise business. Both are for $1.1 billion, and one comes from I Squared Capital (ISQ), the company that owns Hong Kong’s HGC Global Communications.

RCom has now released a statement. It said: "The Hon’ble National Company Law Appellate Tribunal (NCLAT) today in the matter of Ericsson petition and Reliance Infratel Limited (RITL) Minority related settlement petition adjourned the hearing to January 22, 2019. Detailed order is awaited from NCLAT."